Under Armour Under Pressure Ratio Analysis.pdf - For the exclusive use of C. Cardenas 2021. W18648 UNDER ARMOUR UNDER PRESSURE: RATIO | Course Hero

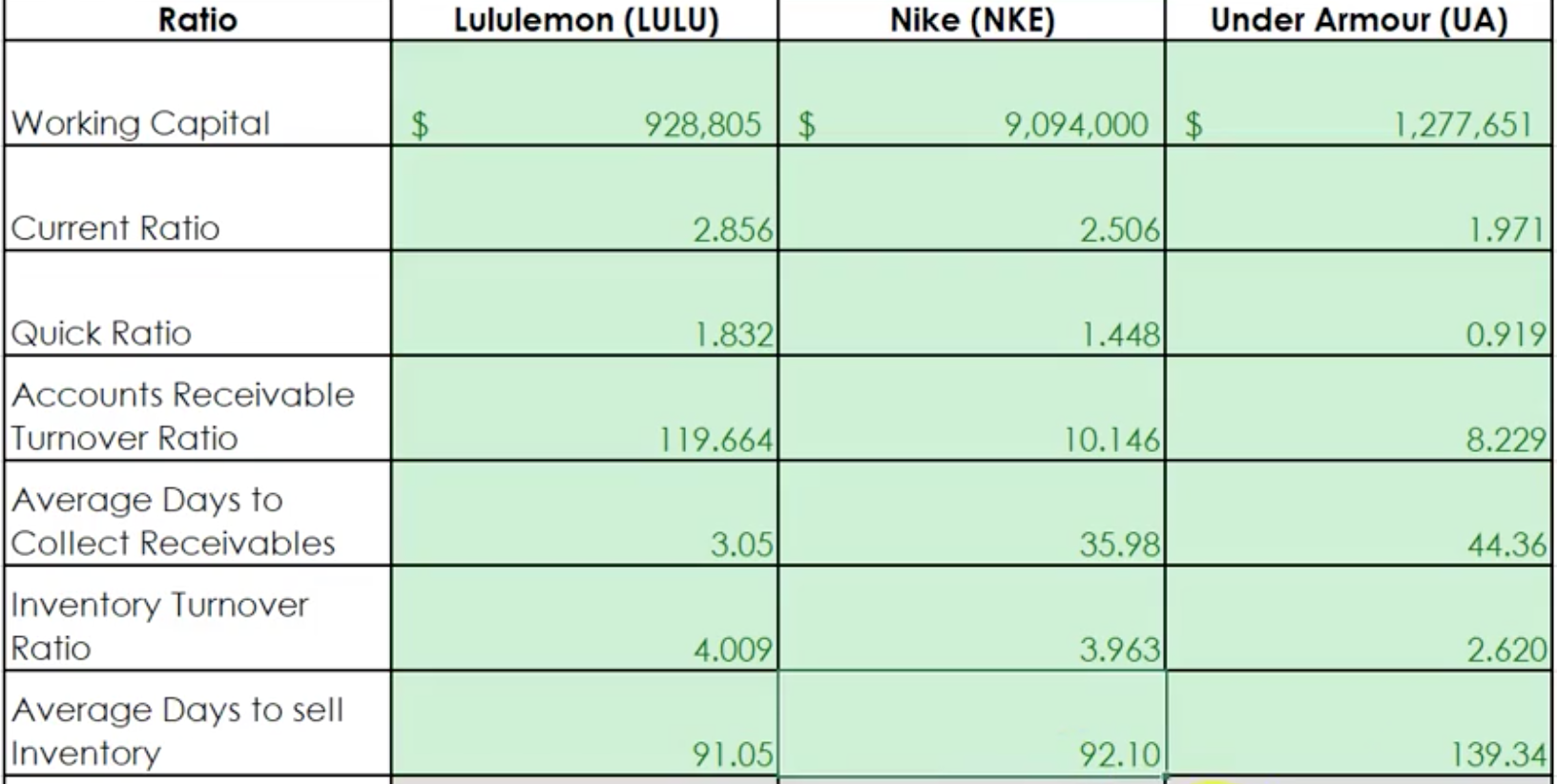

WakeorthoShops - adidas financial ratios worksheet free answer | adidas california summer 2017 tee - Release Info

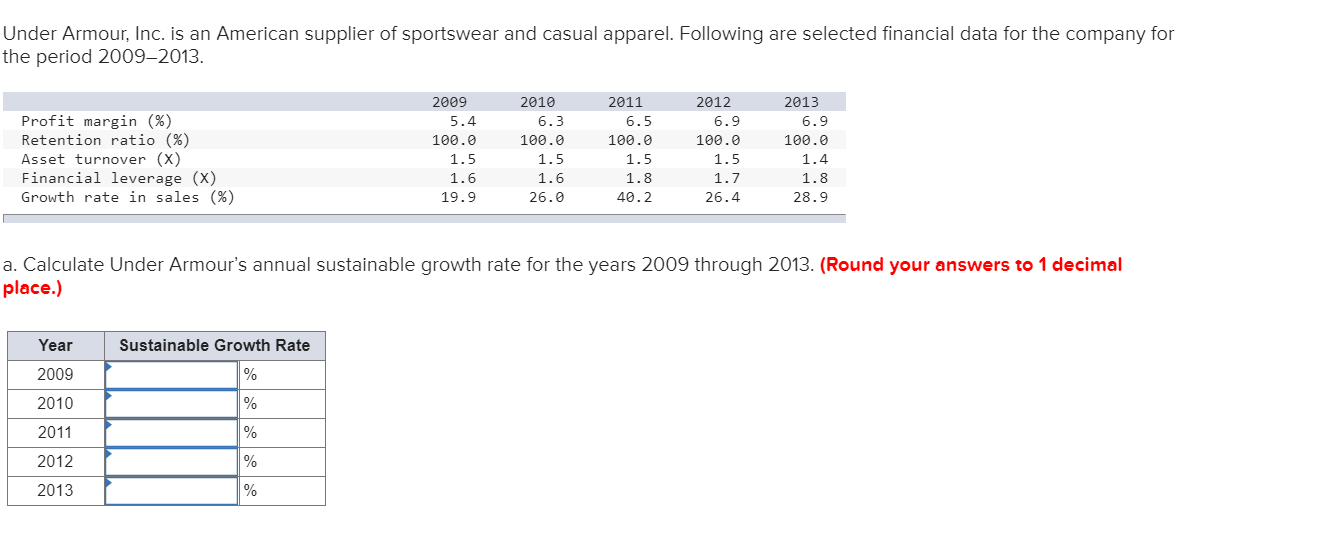

![Solved] Under Armour, Inc. is an American supplie | SolutionInn Solved] Under Armour, Inc. is an American supplie | SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1547/8/3/1/7315c4209b3195ac1547814374632.jpg)